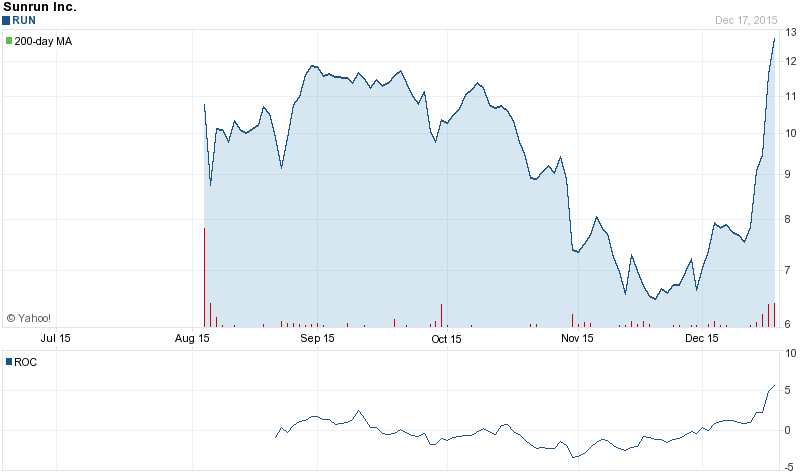

Investors wait Sunrun Inc (NASDAQ:RUN) to report on December, 10. its quarterly earnings The stock decreased 1.77% or $0.14 on December 8, hitting $7.77. Sunrun Inc (NASDAQ:RUN) has risen 6.00% since November 9, 2015 and is uptrending. It has outperformed by 6.80% the S&P500.

Out of 5 analysts covering Sunrun Inc (NASDAQ:RUN), 5 rate it “Buy”, 0 “Sell”, while 1 “Hold”. This means 83% are positive. $23 is the highest target while $15 is the lowest. The $17.8 average target is 112.36% above today’s ($7.77) stock price. Sunrun Inc was the topic in 6 analyst reports since August 31, 2015 according to StockzIntelligence Inc. KeyBanc Capital Markets initiated the stock on October 21 with “” rating. Goldman Sachs initiated the shares of RUN in a report on August 31 with “Buy” rating.

Get a free copy of the Zacks research report on Sunrun Inc (RUN).

More notable recent Sunrun Inc (NASDAQ:RUN) news were published by: Fool.com which released: “Why Sunrun Inc’s Shares Dropped 10% in November” on December 08, 2015, also Wsj.com with their article: “Sunrun Inc. Prices IPO at $14 a Share” published on August 04, 2015, Fortune.com published: “What Sunrun’s IPO says about the solar industry and Silicon Valley” on June 26, 2015. More interesting news about Sunrun Inc (NASDAQ:RUN) were released by: Fool.com and their article: “Why Sunrun Inc’s Shares Plunged 13% in September” published on October 05, 2015 as well as Bidnessetc.com‘s news article titled: “Why Credit Suisse Added Sunrun Inc (RUN) To Top Picks List?” with publication date: October 01, 2015.

Sunrun Inc. provides solar energy to homeowners. The company has a market cap of $799.56 million. The Company, either directly or through one of its solar partners, installs a solar energy system on a customer’s home and either sells the system to the homeowner or, as is more often the case, sells the energy generated by the system to the homeowner pursuant to a lease or power purchase agreement . It currently has negative earnings. The Company’s core solar product offerings are provided through a lease or a power purchase agreement, which are substantially similar to one another.

Sunrun Inc - Receive News & Ratings Via Email - Enter your email address below to receive a concise daily summary of the latest news and analysts' ratings with MarketBeat.com's FREE daily email newsletter.