Marvell Technology Group (NASDAQ:MRVL) Price Target Change

In a report revealed to investors and clients by RBC Capital Markets on 28 September, Marvell Technology Group (NASDAQ:MRVL) had its price target raised to $10.00. The firm right now has “Sector Perform” rating on the stock.

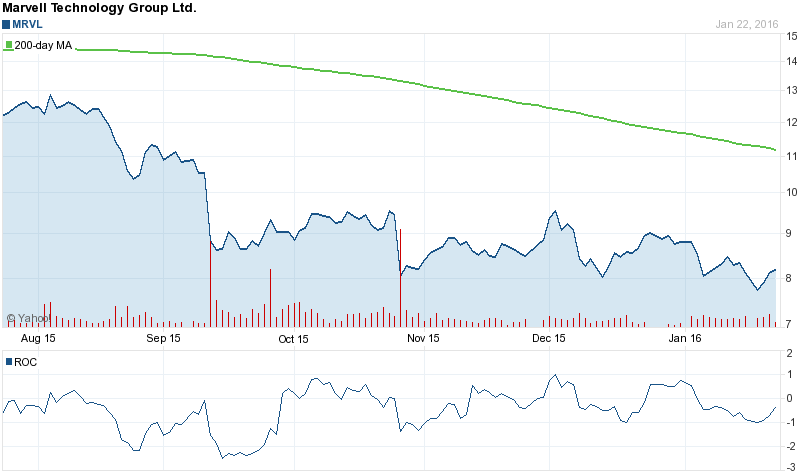

Despite the target increase, NASDAQ:MRVL is now trading -1.93% lower at $9.15 as of 14:52 New York time. Marvell Technology Group shares have decreased -36.24% in the past 200 days, while the S&P500 Index has decreased -6.24% in the same time.

Out of 24 analysts covering Marvell Technology Group, 6 rate it a Buy, 19 indicate a Hold while 3 suggest a Sell. The highest target is $17 and the lowest is $7 according to Thomson/First Call. The 12-month mean target is $11.29, which means upside potential of 23.39% over the current price.

Institutional Ownership

Bow Street Llc had the biggest stake with ownership of 792,878 shares as of Q2 2015 for 5.05% of the fund portfolio. Shannon River Fund Management Llc is another bull as the investment professional who is having 2.95 million shares of Marvell Technology Group or 3.82% of their fund portfolio. In addition, Hoertkorn Richard Charles have 2.42% of their fund portfolio invested in the company for 246,243 shares. The Michigan-based fund Seizert Capital Partners Llc revealed it had acquired so far a stake worth about 2.17% of the investment professional’s stock portfolio in Marvell Technology Group. The California-based fund Connective Capital Management Llc is also positive about the stock, possessing 6.46 million shares or 1.48% of their fund portfolio.

Marvell Technology Group (NASDAQ:MRVL) Profile

Marvell Technology Group Ltd. (Marvell) is a fabless semiconductor provider of application-specific standard products. The Company develops System-on-a-Chip (SoC) devices. Its product portfolio includes devices for data storage, enterprise-class Ethernet data switching, Ethernet physical-layer transceivers (PHY), mobile handsets, connectivity, Internet-of-Things (IoT) devices and other consumer electronics.

Marvell Technology Group (NASDAQ:MRVL) traded down -1.93% on 28 September, hitting $9.15. A total of 3.75M shares of the company’s stock traded hands. This is down from average of 8.90 million shares. Marvell Technology Group has a 52 week low of $8.21 and a 52 week high of $16.78. The company has a market cap of $4.84B and a P/E ratio of 0.