Shire PLC (ADR) (NASDAQ:SHPG) Rating Maintained

In analysts note issued by RBC Capital Markets on Monday morning, Shire PLC (ADR) (NASDAQ:SHPG) stock “Sector Perform” was maintained.

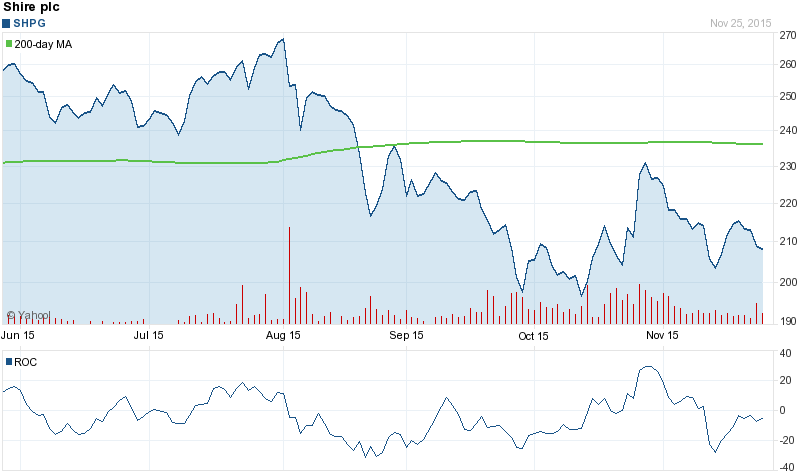

NASDAQ:SHPG is right now trading -3.34% lower at $201.59 as of 15:16 New York time. Shire PLC (ADR)’s stock is up 1.35% in the past 200 days. It has outperformed the S&P 500 Index, which has declined -6.24% in the same time period.

According to data compiled by Thomson Reuters, Shire PLC (ADR) (NASDAQ:SHPG)’s stock is covered by 11 equity analysts across the Street, with 0 analysts giving it a Sell rating, 7 a Buy rating, while 4 consider it a Hold. The 12-month consensus target price for the stock is $283.91, which reflects an upside potential of 40.84% over the current price.

Shire PLC (ADR) (NASDAQ:SHPG) Profile

Shire plc is a biopharmaceutical company. The Company, along with its subsidiaries, is engaged in developing and marketing medicines for patients with rare diseases and other specialty conditions. The Company commercializes its products in the areas of Neuroscience, Gastrointestinal (GI), Rare Diseases and Other therapeutic areas.

Shire PLC (ADR) (NASDAQ:SHPG) traded down -3.34% on 28 September, hitting $201.59. A total of 1.11 million shares of the company’s stock traded hands. This is up from average of 747,712 shares. Shire PLC (ADR) has a 52 week low of $156.25 and a 52 week high of $270.63. The company has a market cap of $42.31 billion and a P/E ratio of 12.88.