BlackBerry (NASDAQ:BBRY) Rating Maintained

In an analyst report issued to clients on 28 September, BlackBerry (NASDAQ:BBRY) stock had its Hold Rating restate by equity analysts at Deutsche Bank. They currently have a $6 PT on company. Deutsche Bank’s target would suggest a potential downside of -3.38% from the company’s last close price.

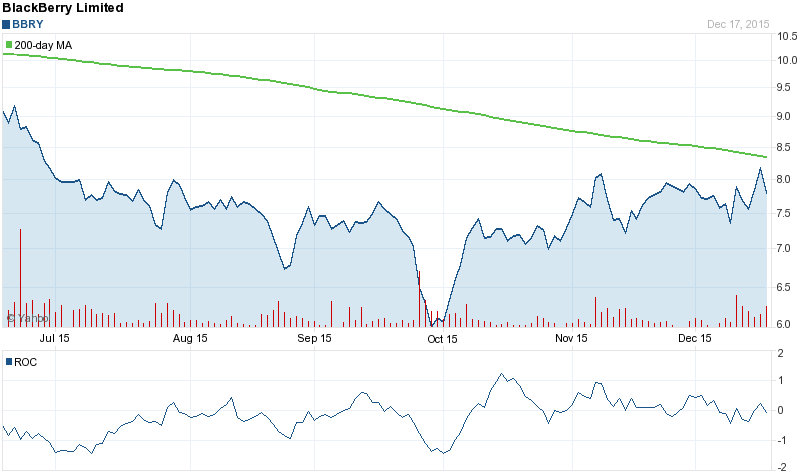

NASDAQ:BBRY is currently trading -4.31% lower at $6.21 as of 13:49 New York time. BlackBerry’s stock is down -38.01% over the last 200 days. It has underperformed the S&P 500, which has dropped -6.24% over the same time.

BlackBerry (NASDAQ:BBRY) Profile

BlackBerry Limited (BlackBerry) is a provider of mobile communications and services. The Company is engaged primarily in the provision of the BlackBerry wireless solution, consisting of smartphones, service and software. The Company’s four areas of business are Devices business, Enterprise Services, BlackBerry Technology Solutions (BTS) business and Messaging.

BlackBerry (NASDAQ:BBRY) traded down -4.31% on 28 September, hitting $6.21. A total of 8.06M shares of the company’s stock traded hands. This is up from average of 7.08M shares. BlackBerry has a 52 week low of $6.14 and a 52 week high of $12.63. The company has a market cap of $3.42B and a P/E ratio of 0.